Support

-

User Guide

-

1 Registration

-

2 Registration

-

3 Login

-

4 Practice mode

-

5 Wagertool layout

-

6 Main Wagertool bar

-

7 Markets window

-

8 Livescores window

-

9 Settings

-

10 Logger

-

11 Grid view

-

12 Ladder view

-

13 Bet persistence types

-

14 Chart view

-

15 All markets view

-

16 More market details

-

17 Stake types

-

18 Multibet view

-

19 Betting automation

-

20 Line markets

-

1 Registration

-

Knowledge Base

-

FAQ

Betting automation

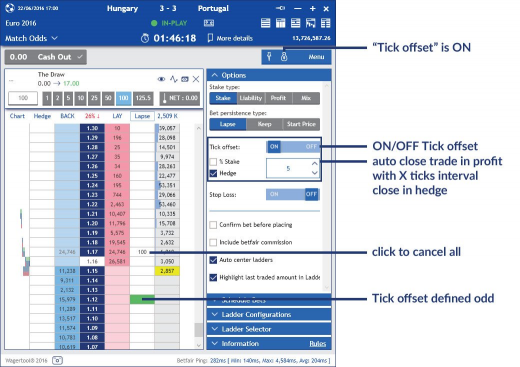

This is a betting option that automatically closes the trade in profit with a tick offset previously defined by you:

• If the trade began with a BACK bet, Wagertool will place a LAY bet x ticks bellow;

• If the trade began with a LAY bet, Wagertool will place a BACK bet x ticks above.

The closing trade bet will only be placed when the total amount of the initial bet has been matched. The target odd will be colored green in the ladder.

If you tick the %Stake option, the value you enter in the box is a percentage of the initial bet to be set as your desired profit. Wagertool will automatically calculate the desired exit odd taking this value into account. Otherwise, the value you enter in the box is the tick offset.

If you tick the Hedge option, the amount of the closing bet will be calculated to guarantee profit in all selections of the market. Otherwise, the amount of the closing bet will be the same as the opening trade bet.

Note: If you cancel the initial trade bet before it’s been matched, the programmed trade closing bet will also be cancelled.

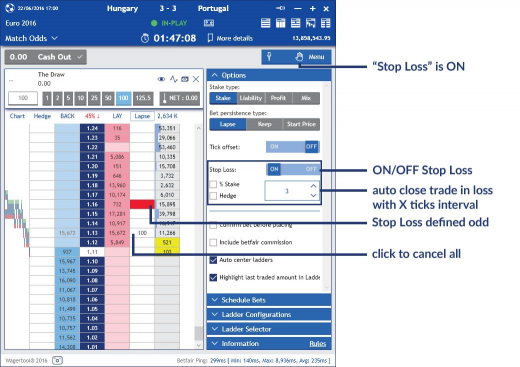

This is a betting option that automatically closes the trade with a maximum loss limit previously defined by you:

• If the trade began with a BACK bet, Wagertool will place a LAY bet x ticks above;

• If the trade began with a LAY bet, Wagertool will place a BACK bet x ticks bellow.

The closing trade bet will only be placed when the total amount of the initial bet has been matched. The target odd will be colored red in the ladder.

If you tick the %Stake option, the value you enter in the box is a percentage of the initial bet to be set as your desired maximum loss. Wagertool will automatically calculate the desired exit odd taking this value into account. Otherwise, the value you enter in the box is the tick offset.

If you tick the Hedge option, the amount of the closing bet will be calculated to divide the loss equally by all selections of the market. Otherwise, the amount of the closing bet will be the same as the opening trade bet.

Note: If you cancel the initial trade bet before it’s been matched, the programmed trade closing bet will also be cancelled.

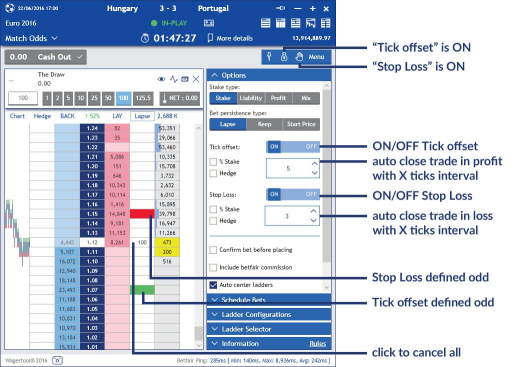

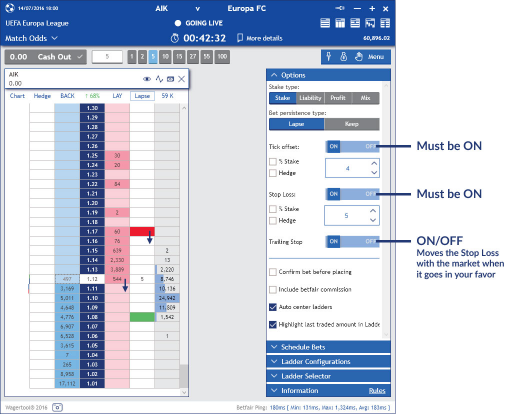

Tick Offset combined with Stop Loss

This is an automatic betting option that combines the previous Tick Offset and Stop Loss options, which is a common option used by traders.

These options work well together, since one lets you define the tick offset for your desired profits, while the other protects you from unwanted losses, allowing you to keep trading with peace of mind.

The Wagertool Trailing Stop continuously changes Stop Loss target odds to take advantage of favorable market movements. This means your position will be closed at better odds.

To use this feature, both Tick offset and Stop Loss must be turned ON.

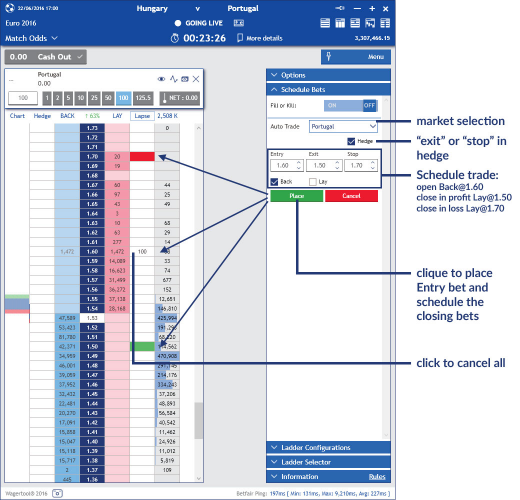

The Auto Trade option is similar to the combination of Tick Offset and Stop Loss but. However, in this option you set the desired entry and exit odds manually, instead of defining tick offsets.

Note: The odd value you define in the entry box is the lowest odd (BACK) or the highest (LAY) you desire. Therefore, if there are better odds in the market, Wagertool will place the bet at the best available odd as soon as you hit Place to schedule the bets.

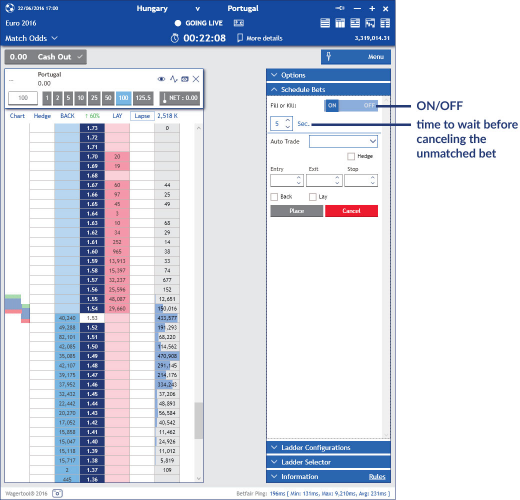

This option allows you to define a time validity period for your unmatched or partially unmatched bets, so Wagertool will cancel a bet x seconds after it’s become available in the market.

Note: In live events, Betfair defines a delay time which is the same for all users. The time you define in the Fill or Kill option only starts counting after the Betfair delay time.